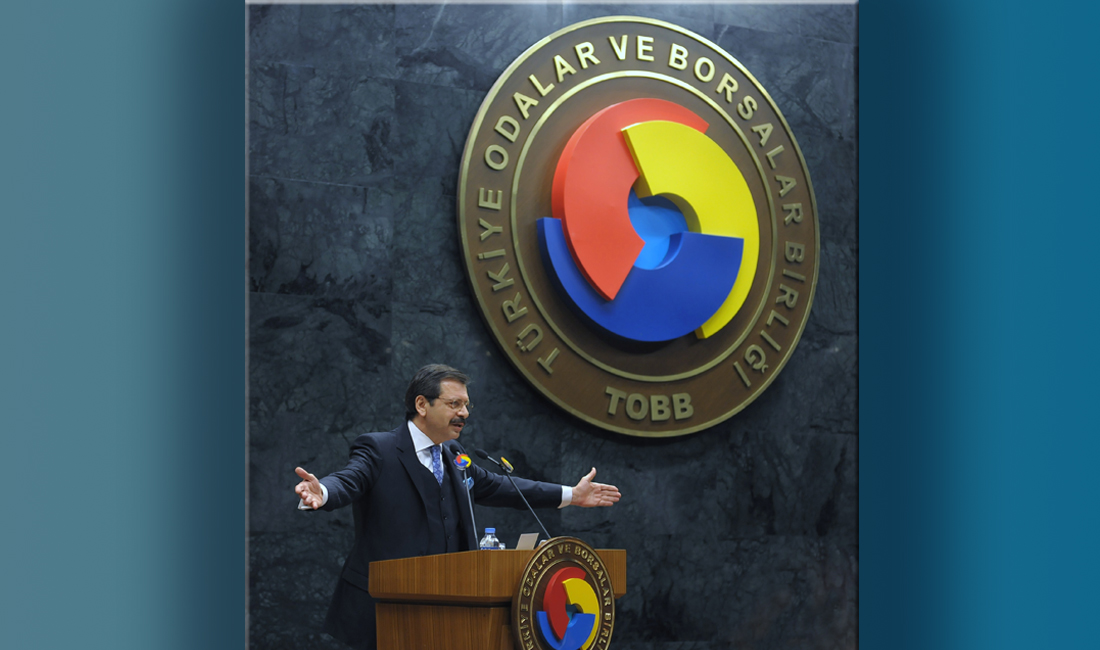

Hisarcıklıoğlu calls on banks for “interest rate cut and restructuring”

11.09.2019 / Ankara

The Union of Chambers and Commodity Exchanges of Turkey (TOBB) President M. Rifat Hisarcıklıoğlu, noting that high interest rates are the greatest obstacle to production and investment, said, “We are pleased to see that interest rates have been falling for a while now, however it is still not conducive to engaging in global competition at their present state.”

Hisarcıklıoğlu, in a statement to Anadolu Agency reporters, stated that the Central Bank of Turkey (CBT), under new administration, has adopted the proactive approach which they’ve need and has made reductions in policy interest rate.

M. Rifat Hisarcıklıoğlu said that as the business world, they expect the Bank to continue to lower the policy rate and that the conditions for a new interest rate cut have been formed with the decline in inflation and interest rate decreases in global markets.

Stating that high interest rates are the greatest obstacle to production and investment, Hisarcıklıoğlu said, “We are pleased to see that interest rates have been falling for a while now, however it is still not conducive to engaging in global competition at their present state. The financial burden on the real sector needs to be further reduced.”

Hisarcıklıoğlu stated that they regretted that the policy rate cut was not adequately reflected in the loan interest rates of the banks and said:

“Public banks have taken rapid steps in this direction. Unfortunately, we do not see the same approach enough in private banks. Both interest rate cuts and credit structures are causing difficulties for our companies. Banks should stop thinking short-term and do their part.”

- "Credit restructuring should be implemented quickly"

TOBB President Hisarcıklıoğlu stated that the restructuring of credit debts is another important issue for the real sector and that there are many businesses operating efficiently and properly despite the short-term shortage of cash flows throughout Anatolia.

Emphasizing that these companies contribute to production, export and employment, Hisarcıklıoğlu stated that these enterprises are the national wealth of the country and they should be protected; that private banks do not act fast enough in structuring their loan debts and they make the companies wait. Hisarcıklıoğlu said the following:

“That is why our real sector is losing blood. Our Minister of Treasury and Finance Berat Albayrak has followed this issue closely and has opened the way for the banks, but the banks are still dragging their feet. Framework contract negotiations have been going on for months. We are awaiting the restructuring of credit loans as quickly as possible. I will urge our banks once again: We're all in the same boat; let’s work together, let's quickly complete restructuring. Let’s open the way for production, employment and investments; let’s open the way for Turkey.”

Your message has been sent

Thank you |