Turkey outperforms US and EU countries in card spending

02.09.2021 / Ankara

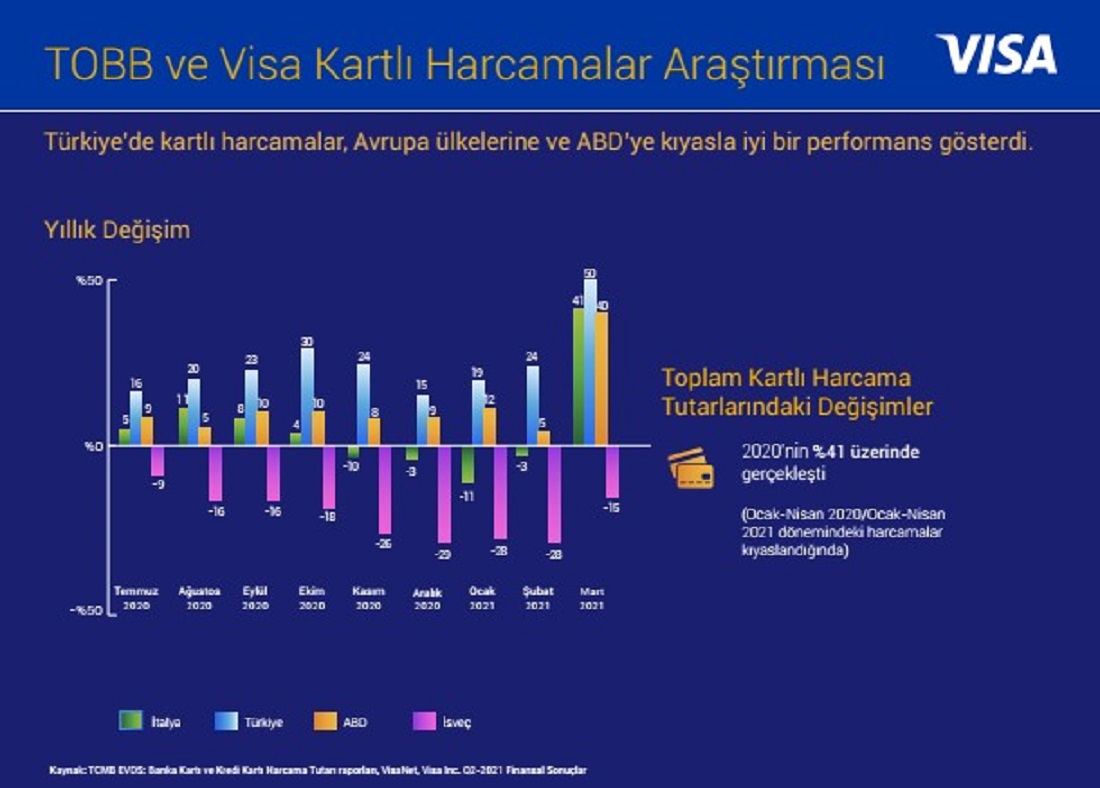

According to the Expenditures Survey conducted by the Union of Chambers and Commodity Exchanges of Turkey (TOBB) and Visa, as of the first months of 2021 (January-April), card spending increased by 41% compared to the same period last year. e-Commerce, debit cards and contactless payment were the 3 stars of card spending, which continued to grow in the second wave of the pandemic.

Evaluating the results of the research, TOBB President Hisarcıklıoğlu pointed out that thanks to the dynamic structure of the Turkish business world during the pandemic, it successfully implemented applications such as e-commerce and takeaways through a rapid transformation process. Merve Tezel, Managing Director of Visa Turkey, said, “The research shows that Turkey is on a growth trend in terms of card spending in the second wave of the pandemic.”

- 41% increase

TOBB and Visa shared the second research examining the impact of Covid-19 on card spending in Turkey with the public. The second wave of the pandemic, which coincided with the winter months, and the first four months of 2021 were analyzed in the second expenditures survey, the first of which was conducted looking at the period of March-August 2020. According to the results highlighted in the study, the recovery process that started with the normalization in the summer of 2020 in Turkey slowed down in December, when the second wave began, but quickly regained its old momentum. As of the first months of 2021 (January-April), card spending increased by 41% compared to the same period last year.

- Turkey held up better than other countries

The study draws comparisons with Italy, which took early and restrictive measures during Covid-19, Sweden, which imposed fewer restrictions than other countries, and the United States, which took similar restrictive approaches to Turkey. Accordingly, it turns out that Turkey performs better than other countries. At the beginning of the second wave, Sweden experienced sharp declines in card spending, while the US and Turkey, which imposed similar restrictions, experienced close fluctuations in the card spending chart. It is also noted that Turkey held up better test than the other three countries in all months between July 2020 and March 2021. Compared to March 2021 of the previous year, card spending grew by 50% in Turkey, 40% in Italy and the United States, and shrank by 15% in Sweden.

- 3 stars of card spending were e-commerce, debit cards and contactless payment

In Turkey, 3 significant jumps stand out in the payments world compared to expenditures in the period April 2019-March 2020 and April 2020-March 2021. The fact that e-commerce reached record levels in Turkey by 55%, debit card spending increased by 40% and contactless payments increased 6 times with curfews and changing consumer habits indicates the building blocks of the growth in card payments. Debit card spending, which accounts for 17% of card payments, is also notable for increasing by 2.5 times credit card annual growth.

- Emerging sectors of the pandemic: Electrical-electronics and building-decoration

Within the scope of the research, changes due to the Covid-19 process in different sectors were also analyzed. Accordingly, in the second wave of the pandemic, where it is mandatory to stay at home and distance education continues, there was rapid and permanent growth in the market-shopping mall-food, building-decoration and electrical-electronics sectors due to the fact that consumers have now adopted e-commerce. In the market-shopping mall-food sectors category, in April 2021, there was a 41% increase compared to the same period last year, compared to 82% in the electrical and electronics sector and 118% in the building-decoration sector.

- The food and drink sector has adapted to the pandemic conditions

The effect of additional restrictions that came with the second wave of the pandemic was observed, especially in the food (restaurant) sector. The remarkable development in the restaurant sector is that spending in this area has tripled compared to April 2020 when looking at April 2021. This increase shows that businesses that have switched to takeaways and started taking orders online are adapting to digital transformation.

- TOBB President M. Rifat Hisarcıklıoğlu

Evaluating the results of the research, TOBB President M. Rifat Hisarcıklıoğlu said that the dynamic structure of the Turkish business world positively separates Turkey from other countries. “Every crisis brings its own opportunity. During the pandemic we are going through; the Turkish business world, thanks to its dynamic structure, has become better able to respond to consumer needs by implementing e-commerce, takeaway, etc. applications through a rapid transformation process. This transformation allowed both companies to be less affected by the pandemic and for consumers to continue their consumption habits.”

Hisarcıklıoğlu stated that they guided the companies as TOBB in the process of the transformation that the business world has undergone, and emphasized that the pandemic process shows once again that e-commerce should never be neglected. The TOBB President said, “During this period, we found that 1/3 of credit card expenditures were made through e-commerce. We also organized many online information meetings to prepare our members for e-commerce. In addition, we have created certified e-commerce and e-export training programs. We have prepared special campaigns with many e-commerce platforms for our members to take part in e-commerce and made them available to our members.”

Hisarcıklıoğlu reminded that TOBB and Visa have implemented the 'A Purchase Makes A Lot of Difference' campaign with the slogan of #BuSeslerHiçBitmesin, “By raising awareness, we tried to explain that it is important for consumers to make their purchases from small businesses for the continued health of the economy.”

- Visa Turkey General Manager Merve Tezel

Commenting on the results of the research, Visa Turkey General Manager Merve Tezel said, “The Visa and TOBB Expenditures Survey reveals that Turkey is on a growth trend in terms of card spending in the second wave of the pandemic. The driving forces of this performance were online spending, which appeared to have jumped the threshold compared to before the pandemic, the continued rise of contactless, which has now become the norm in payment preferences, and the increase in spending on debit cards. The fact that the card payments infrastructure in our country has developed to respond to the change in consumer behavior has a big impact on this growth trend. Again, according to the results of the research, we see that SMEs operating in many sectors, especially in the food sector, harmonized their business according to changing consumer expectations in the second wave of the pandemic. As Visa, we will continue to support the digitization of SMEs in the light of these outputs with the I Manage My Business project and the Smart SME platform we have implemented with TOBB.”

Your message has been sent

Thank you |