Card spending in Turkey recovers faster than Europe during normalization process

21.10.2020 / Ankara

According to the Spending Survey of Visa and the Union of Chambers and Commodity Exchanges of Turkey (TOBB), card spending in Turkey, which narrowed in March-May, entered a rapid recovery with normalization.

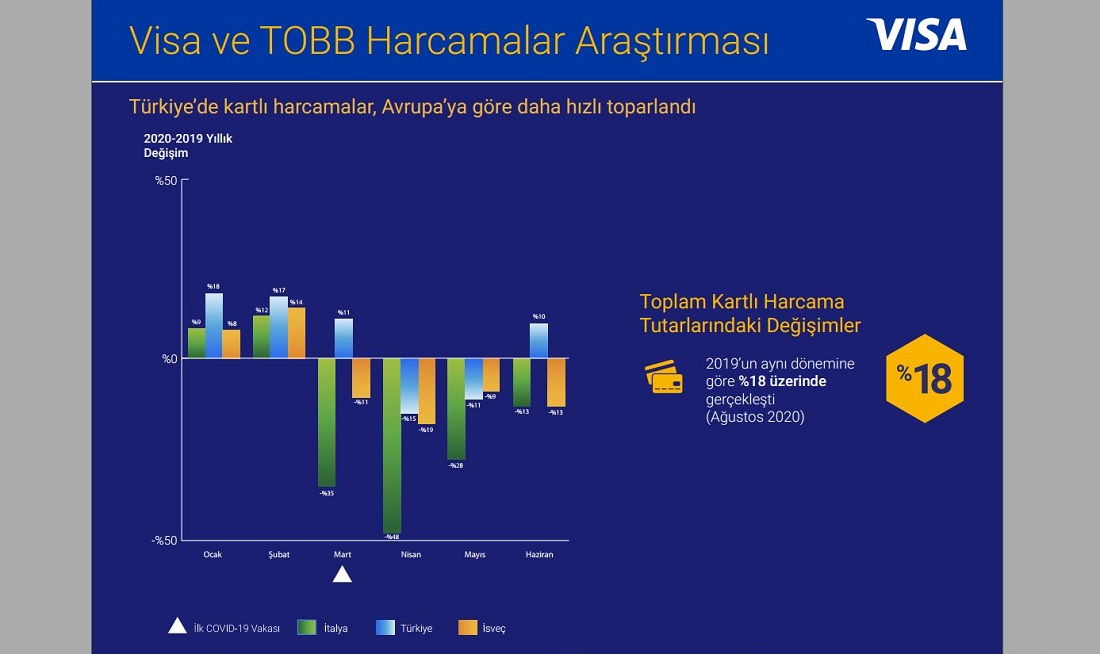

Card payments were 18% above the 2019 level as of the last week of August. The study also compared spending data from Sweden and Italy with Turkey's. He pointed out that Turkey is going through this process with less damage compared to Europe and sectors are recovering more quickly.

Visa and the Union of Chambers and Commodity Exchanges of Turkey (TOBB) conducted a study examining the COVID-19 effect on card spending in Turkey.

Focusing on the period March-August 2020, the study analyzed changes in card spending due to the COVID-19 process for different sectors, non-contact transactions and e-commerce transactions. Total card spending shrunk by 10% compared to the same period last year during the 12-week period (March-May) when curfews were imposed in Turkey due to the outbreak. In June, as normalization began, spending began a rapid recovery and rose 18% above the 2019 level in the last week of August.

- Turkey compared to two extreme countries in pandemic restrictions, Sweden and Italy

The Visa and TOBB Expenditures Survey also includes comparisons with the two countries that took a different approach during the epidemic: Italy, which first implemented curfews in Europe, and Sweden, which did not impose restrictions. Between March and May, Italy experienced the sharpest declines in card spending, while In April and May, Turkey and Sweden experienced parallel and close fluctuations. Sweden and Italy continued to shrink by 13% in June, while Turkey grew by 10% with normalization in the same month, recovering quickly, compared with the tables of the six main spending sectors a year ago.

- Turkey tops Europe in contactless transaction growth

Turkey was the first country in Europe to raise the limit on contactless spending during the pandemic process. Consumers also showed a growing demand for contactless payments due to health priority. According to Interbank Card Centre figures, 2.5 million cards were used for contactless payments for the first time in March only. Thus, in Turkey, the number of contactless transactions in the first 6 months of 2020 increased threefold compared to the same period last year. The Visa and TOBB Expenditures Survey also reveals the figure of this increase very clearly. With the growth rate of contactless payments, Turkey stands out as the country with the highest increase in Europe. However, the rate of contactless transactions in our country is lower compared to the European average, where 75% of face-to-face payments occur without contact. To further popularize the acceptance of contactless payments, Visa continued its work even during the pandemic period and implemented close to 7000 contactless payment points in cooperation with retail brands.

- E-commerce hits record highs

During the period covered by the research, e-commerce transaction customs in our country increased by 30% in April 2020 only as consumer habits changed. In 14 European countries, the figure has increased by more than 25%. In Turkey, 7 million cards were used for e-commerce transaction for the first time between March and May. As a result, e-commerce in our country reached record levels, reaching 33% of card spending as of the end of May.

- Spending figures outperforming many sectors in 2019 with normalization

On-demand consumption expenditures such as clothing, travel, electrical and electronics were above basic necessity expenditures such as grocery stores and food before the pandemic, while spending in these sectors fell by around 58% in March, when the first COVID-19 case in Turkey was seen. However, with normalization, 'on-demand consumption' expenditures began to recover, especially with the increase in electrical-electronics and building-decoration expenditures and the improvement in other sectors and approached the level of basic needs expenditures again.

- Increased demand for the electrical and electronics sector during the period of working from home and distance education

During the period of curfews (March-May), the sectors experiencing increased demand compared to last year were electrical-electronic goods-computers, grocery stores and food. During this period, there were decreases in the categories of travel, food, clothing and fuel. With the start of remote work and remote education in March, the significant increase in spending on electrical-electronics and building-decoration was noted. In particular, electronics spending continued to increase in June-August, with 2019 at over 95%, pointing to the persistency of this demand.

- “Turkey's proactive approach limited the effects of the pandemic”

Evaluating the results of the research, TOBB President M. Rifat Hisarcıklıoğlu said, “During the pandemic, the whole world faced an environment which it was not accustomed to at all. Countries that are prepared and proactive to adapt to this new medium have positively differentiated from other countries. Turkey has been one of the most prominent countries in the world in adapting to this new medium by making quick decisions during the pandemic process and especially with the breakthroughs it has made in the field of health. We have seen the reflection of this in concrete both with the emergence of e-commerce in this process and with the increase in contactless payments.”

Stating that they are in constant communication with Chambers-Exchanges, Sector Councils, Women and Young Councils and OIZs during the pandemic, Hisarcıklıoğlu said, “Throughout the pandemic, we closely followed the problems of our members with the consultation mechanisms we established in the field, receiving constant updates. We have followed up on the solution of these problems by developing solution proposals and forwarding them to the relevant public institutions and organizations. In this period, I can say that many problems from our members have been solved with this method. Again, we have seen that the proactive steps taken during this period accelerated the normalization process.”

Hisarcıklıoğlu concluded, “The pandemic showed us once again the importance and future of e-commerce. During this period, we saw that one-third of credit card spending was made through e-commerce. We have organized many online information meetings to prepare our members for e-commerce. In addition, we have introduced certified e-commerce and e-export training programs for our members to take part in e-commerce; we have prepared e-commerce-specific campaigns with many companies and made them available to our members.”

- “A positive outlook for Turkey”

Visa Turkey General Manager Merve Tezel said, “Visa and TOBB's Spending Survey shows a positive outlook for Turkey. With the start of the normalization process in our country, we see a faster recovery in all sectors compared to Europe. The prevalence of payment systems in Turkey, consumers' card usage habits and strong e-commerce infrastructures played an important role in the recovery.”

Tezel added: “The pandemic process has led to significant changes in both consumer behavior and the structure of businesses. During this period, consumers turned to online payments in virtual environments and contactless payments in the physical world. Contactless card usage in our country normally grows by 2 times each year on average, while in only the first 6 months of this year it has grown 3-fold. We also observed that the acceptance of contactless payments can result in increases in turnover in some workplaces. We expect contactless card usage rates in Turkey to reach the European level.”

Tezel said that the transformation from cash to card payment also contributed to the registered economy, “On the business side, we saw that this process was easier for small and medium-sized companies that accepted electronic payment methods during the pandemic and took their business to digital media. During this period, Visa continues our support for SMEs that form the backbone of the economy within the scope of our I Manage My Business Project, both with the virtual trainings we offer and with the support of digitalization and digital marketing.”

Your message has been sent

Thank you |